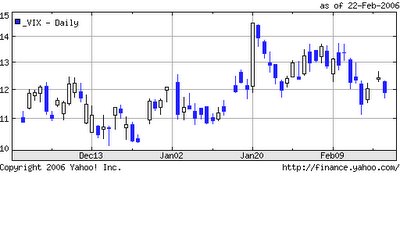

TRADING BY THE VOLATILITY INDEX

If one looks at these two Indexes together, one can see a definite relationship between the VIX index and the SPY index. When the SPY goes higher, the VIX generally goes lower and vice versa. A good general rule is that when the VIX is stretched 10% or more from its 10 day moving average, its time to either BUY or SELL the indexes.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home