WORLD SERIES UPDATE

The markets are crawling back at the 1:00 hour with the internals trying to get back to the flatside. The strongest ETF's, yes, you have guessed correctly, the QQQQ and SMH. Also on the upside are Small caps and Metals. The flatish sectors are biotechs financials and the Volatility Indexes. GOOG still stands out to the upside.

One question of today is Why does TheStreet.com publish and tout Lenny Dykstra's Option ideas.?

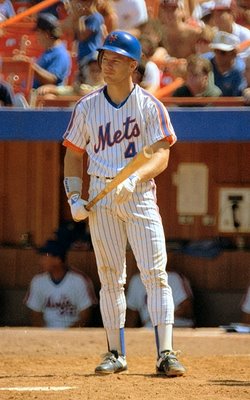

If you don't know, Lenny (nickname NAILS) was a very good center fielder for the New York Mets and the Philadelphia Phillies back in the 80's and 90's. Lenny was known as a hard nose player who ran fast, played hard and always had a dirty uniform. What I find confusing is why this correlates to making money in the options market. Buying deep in the money calls may be a good idea if some cheap puts were owned or some stock was shorted against it. To just buy the calls and wait for the money to roll in is a risky proposition. We all know that one or more of these stocks will blow up and the "inexpensive" options will expire worthless.

So my question is why does thestreet.com hire Lenny to write this column when there are many qualified option traders who have as much or more experience trading as Lenny did playing centerfield. I guess its the entertainment /novelty value of having an option trading World Series winning ex centerfielder. For more on the silliness, please read today's Daily Option Report.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home