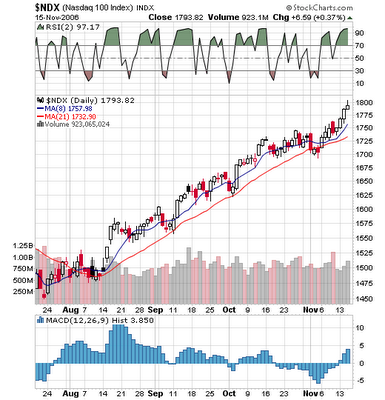

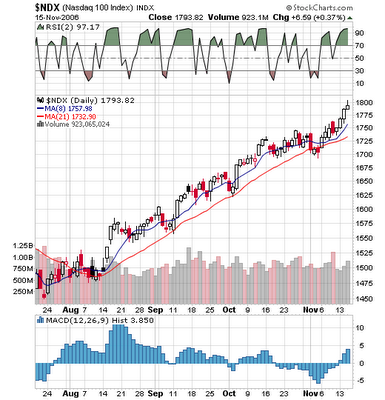

Futures have the markets set to open lower on the heels of the DELL delay/AMAT disappointment or even more likely, overbought conditions in the major indexes. Buying the NDX at the 8 or 21 day SMA has been a very profitable trade on several occasions and I suspect it will happen again. Calling for the markets to reverse and head lower has not been a good strategy lately and I don't plan on fighting the current trend. The amusement of the day will probably be waiting to see how long it takes for the bulls to buy the dips and send the markets higher. Ooops, and just as I type, news crosses that RDA will be bought out by private buyout firm Ripplewood and up go the futures. And up go the futures on low inflation and good jobs numbers. Say LIQUIDITY. Say Higher prices.

Futures have the markets set to open lower on the heels of the DELL delay/AMAT disappointment or even more likely, overbought conditions in the major indexes. Buying the NDX at the 8 or 21 day SMA has been a very profitable trade on several occasions and I suspect it will happen again. Calling for the markets to reverse and head lower has not been a good strategy lately and I don't plan on fighting the current trend. The amusement of the day will probably be waiting to see how long it takes for the bulls to buy the dips and send the markets higher. Ooops, and just as I type, news crosses that RDA will be bought out by private buyout firm Ripplewood and up go the futures. And up go the futures on low inflation and good jobs numbers. Say LIQUIDITY. Say Higher prices.

Futures have the markets set to open lower on the heels of the DELL delay/AMAT disappointment or even more likely, overbought conditions in the major indexes. Buying the NDX at the 8 or 21 day SMA has been a very profitable trade on several occasions and I suspect it will happen again. Calling for the markets to reverse and head lower has not been a good strategy lately and I don't plan on fighting the current trend. The amusement of the day will probably be waiting to see how long it takes for the bulls to buy the dips and send the markets higher. Ooops, and just as I type, news crosses that RDA will be bought out by private buyout firm Ripplewood and up go the futures. And up go the futures on low inflation and good jobs numbers. Say LIQUIDITY. Say Higher prices.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home