NOON TIME

Major market indexes continue higher but some deterioration has taken place and the market internals seem to be one place where it is obvious.

Market internals had gotten to +1,500 into the ramp but have now slipped to +300. The action in the semis and the IWM also seem to be indicating a problem as both are way off their highs with IWM trading flat.

The Oils stocks have climbed back to the flatline in spite of the lower crude prices (down a buck). Whats up with that?

Brokers and banks have the same story to tell as both indexes reached their morning highs soon after the open.

Sectors acting the best include airlines, semis, brokers, tech, internets, trannies and drugs while leading lower are metals and biotechs.

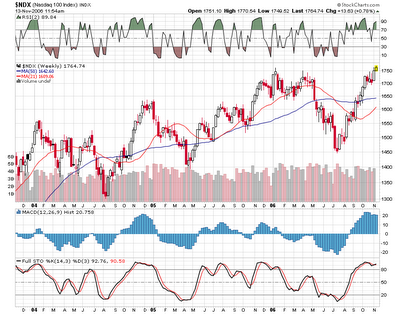

The SPX 1,390 and YM 12,200 levels have been major resistance of late and they may be repelling the buyers again. It also looks like 1,760/1,770 on the NDZ may be an area of resistance as that level was a top back in January and again in April so one may wish to trail the stops here as this certaintly could be an area that the markets have a hard time busting through.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home