UGLY DAY

Markets close near the lows as the NAZ finishes down 36 and the DJIA down 9. Yes, not a misprint as the mean reversion takes hold. Remember the other day when the DJIA was down 40 and the NAZ was up 12 so I guess what ever goes around comes around.

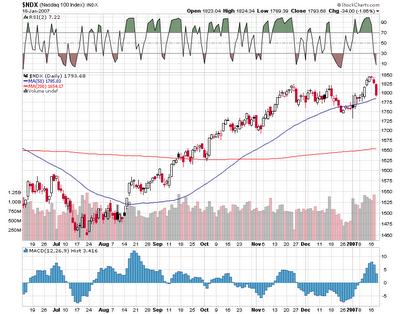

The NAZ was clearly the worst of the big cap indexes and is back at/near its 50 day SMA and trades at a 2 day RSI of 7. So whoever thought it was going to over 100 (yes you), it didn't exactly work out that way. What to do now, my guess buy as evey dip bought since March 2003 has worked I will let the trading gods prove this one to be different.

Market internals were horrible with 700 more losers than winners on the NYSE and 1,360 more losers than winners on the NAZ. The NDX had 15 up and 85 down; the OEX had 34 up and 66 down while the SPX had about 185 up and 315 down.

The TRIN indicator is a bit surprising as it closes at a bullish 94 while the up to down volume on the NYSE was 620M Green and 970M Red. So the up to down volume was a lot better than the advance decline lines.

Strongest sectors were retail, drugs, banks, trannies and homies while tech, gaming, semis, metals, brokers, software, internets and small caps were the worst. Not surprisingly, big cap value did the best, big cap growth second best, small cap value came in third and small cap growth did the worst.

Worst performers on the major indexes were LRCX NVDA KLAC AAPL AMT IBM DELL TXN CSCO and EK while winners were ABT NSC LTD BNI TGT XMSR SIRI TEVA and INTU.

2 Comments:

lll

LOL, yeah it is a bit of a roulette wheel gambling on earnings reports. Especially on these stocks that you know will break 3-5% in one direction or the other...

Post a Comment

Subscribe to Post Comments [Atom]

<< Home