UGLY END

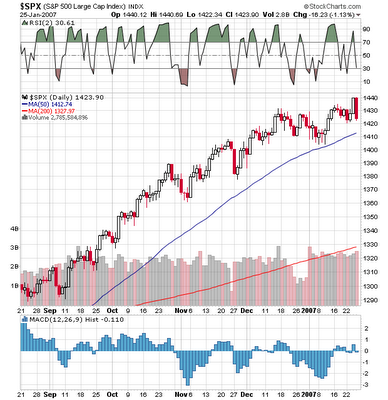

Markets finished yesterday near the lows as it was one of the ugliest days in a long time for the bulls. Market internals had over 3,000 more losers than winners as the rate on the 10 year bond pushed steadily higher throughout the day to close near the 4.87% level.

The thoughts of rate cuts by the fed now seems to be a distant memory as the economy seems to be stronger than most anticipated. The question for investors is do they want a strong economy and steady/higher rates or a weaker economy with steady/lower rates.

Major indexes are a bit oversold on a short term basis and it has "paid" to buy pullbacks since the new bull market began in March of 2003.

The action in the volatility indexes was interesting yesterday as the VXO soared 19% to 10.79 and is now trading about 7% above its 10 day SMA and The VIX also jumpy up 13% and 6% above its 10 day SMA. So neither quite at their buy the markets overbought levels but if we get further slippage next week they probably get there (10% above the 10 day SMA).

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home