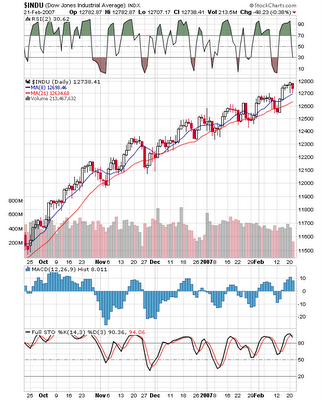

CLOSING DIP

Another day and the big caps outperform again- well not exactly, the RUT and the MID were both up about .2% while the DJIA/SPX/OEX complex were all down on the day. When does that mean reversion thing take hold?

Anyhow, the DJIA closed down 45, NAZ +5 and SPX -2.

Strongest sectors, metals, oils, biotechs, trannies, small cap growth, software, homies, defense and yikes- large cap growth. Weakest were drugs, utilities, reits, financials, semis and tech.

Market internals closed near the flat line on the NYSE and NAZ with a net red number of 350.

The NDX internals were also about flat while the OEX showed 35 up and 65 down; the SPX, about 2 up for every 3 down.

Biggest winners included MHS VMC BTU ATI CMVT AAPL FCX VLO JOYG WFMI and SLB. Biggest losers included HPQ MDT F AVP INTC GM SYMC JNPR DISH GENZ and SUNW.

Volatility indexes a bit lower with the VXO back under 10 and the VIX slightly over at 10.19.

The futures trade worked out pretty well as there were a few bursts near the 12,780 level on the DJIA YM Futures.

I suspect that it won't be long before we start talking about new highs on the DJIA index again for the upteenth time. Maybe even tomorrow as we are only about 65 points away.

One of the really good trades has been to buy the DJIA Futures on a dip and wait for another new high. Its worked like every time in the past several months and I suspect this dip will be no different.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home