AFTERNOON TRADE

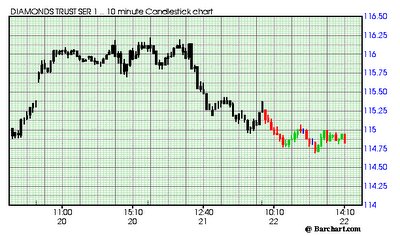

Market internals have done a pretty good job of "telling" that rallies were going to fail today. Of course the day is not over.

The Tick fade trade has been my trade of the day as the afternoon has given a few "short the tick exuberance" trades. I try to get 10/15 DJIA futures points with a tight stop of 15. It works pretty well but has to be done with good size to be meaningful.

One take on the day is that interest rates are lower (10 year Bond 4.6%) and oil is down to the $60.55 level, and the markets can't muster a rally. If this were 10 days ago, the DJIA would be +150 and the NAZ +40 but that was then and this is now and the Philly Fed from yesterday may have knocked some of the bigger slow down sense into folks.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home