THE CLOSE

The markets hit their highs early in the day and sold off most of the afternoon as 1280 on the SPX and 37.25 on the QQQQ continues to be tough resistance levels.

Market internals ended the day with 600 more winners than losers and the best performing sectors were semis, although way off their highs, airlines, techs, reits and trannies. Losers included oils, metals, homies, brokers and banks.

Anyone who daytrades has to watch the action in GS C XBD BKX SMH GOOG and AAPL. These stocks will give a very good indication if strength is to be found or if the market will sell off. If you look at the interday charts on those indexes/stocks you will see that they all made their highs early and sold off the rest of the day. My usual conclusion is that if GS has no jig, the market is going to have a very rough time making upside progress.

Volatility indexes also moved up after giving sell signals early. They are now a hair oversold, except for the VXN, which is on a sell signal. The only area that tempted me today on the long side was the oil patch and my bids never got hit. If we see weakness in the morning I will be buying.

I shorted some QQQQ into the morning ramp and hopefully it will ramp back to the 37.25 area where it always seems to find a top.

1 Comments:

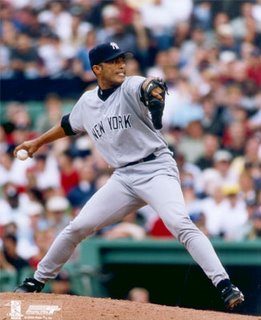

I am in favor of sectarian violence.....provided that it's between Red Sox fans and Yankee fans...............

Post a Comment

Subscribe to Post Comments [Atom]

<< Home