SONG REMAINS THE SAME

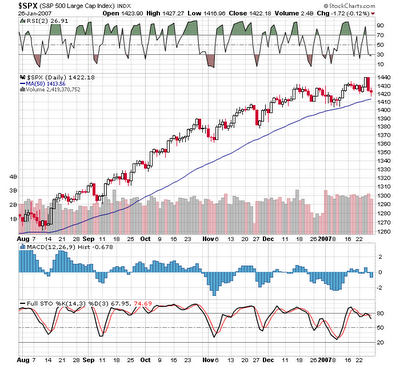

The markets put on an interesting show last week as the DJIA hit an all time high on Wednesday and the SPX hit a new 52 week high. The tech heavy NDX did not confirm as it made its most recent high back on January 16 and the semiconductor etf, SMH hit its most recent high back in mid October.

The markets put on an interesting show last week as the DJIA hit an all time high on Wednesday and the SPX hit a new 52 week high. The tech heavy NDX did not confirm as it made its most recent high back on January 16 and the semiconductor etf, SMH hit its most recent high back in mid October.In addition, volatility heated up on the SPX/DJIA complex as the range last week on the SPX was 24 points vs. about 9 in the prior week. The range on the DJIA also kicked it up a notch with 192 points vs. 91. Surprisingly, the range on the QQQQ contracted to $1.18 from a prior $1.49.

John Carter, the author of the excellent trading book, Mastering The Trade, is a bit bearish in the short term and has found a number of negative divergences. The folks at TickerSense also have some bearish data and the Blogger Sentiment Poll, 46% BEARS, 22% BULLS and 32% Neutral.

My guess is that interest rates come down a bit helping equities and the sell siders scream "you wanted a dip to buy, here it is, go buy it."

The NAZ, down about 75 points, or 3%, from the mid January highs may be bottoming and the SMH also seems to have put in a low as the stocks were strong on Friday and maybe heading higher as the stochastics seem to be hooking up.

I probably sound bullish and I am, but most watching the tape/screens everyday sees demand for equities; so until proven otherwise, dips are for buying.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home