DEVELOPING STORIES?

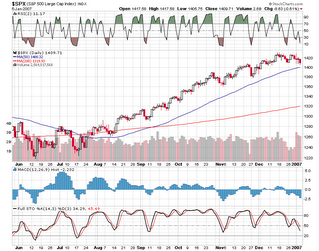

A quick check of the year to dates on various stocks and indexes finds some interesting stats not in any particular order:

The DJIA SPX RUT and OEX are all up less than 1% while the NDX and the HHH internet Holders are both up about 5%; GOOG after being up 11% last year is up a quick 9.7%, and YHOO which was down 35% last year has bounded back a quick 15%.

The DJ Wilshire Value indexes for both large and small caps are red on the year while the Growth indexes are up about 2%. Last year the growth indexes were up about 8% while the value indexes were up about 21%.

The airlines index is up another 12% after being up 7% last year.

Gaming stocks are roaring again after having a banner year with MGM +18%(+56% 2006), LVS+16% (+27% 2006) and WYNN +11% (+71% 2006).

INTC after being down 19% last year, is already up 9.3% this year while the SMH is up 4.3% after dropping 8% in 2006.

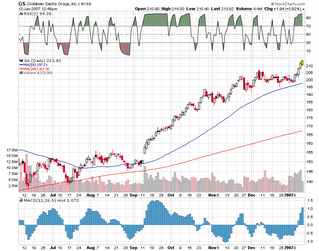

The brokers and exchanges continue to act very well with GS+7.3% (+56% 2006), ICE +25% (tripled in 2006), CME +12.6% (+39% 2006) XBD +6.3% (+23% 2006) and IAI +7% (ETF began mid 2006, +37% from inception).

AMGN after being down 13.4% last year is up 7.3%.

Finally, metals and oils continue the trend from the second half of 2006 with OIH-7%, XLE -5.4%, and HUI-5.4% in the first two weeks of 2007.