ONE MORE TIME

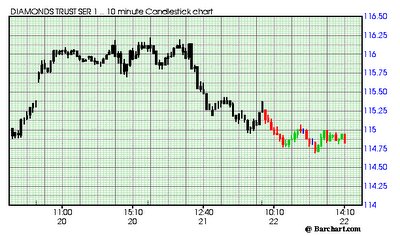

The Tick Fade Trade hit again at around 3:20 est when the ticks went over 1,200 and drove the DJIA Futures contract to 11597; DJIA subsequently backed off along with the ticks to a low of 11571 on the 3:50 bar; 26 points in 20 minutes.

So, if one traded 5 contracts and got 20 of the 27 points that is a quick $500. To day trade 5 contracts on YM, one needs about a $10,000 futures account.

Not bad, and this is one trade that sets up four or five times a day and is quick and reliable if its traded with the trend or in choppy markets.

It is however a trade where one can't be greedy and has to act quickly.