2.24.2006

STOP TRADING

I miss cramer this week. Who else on TV or anywhere else can recommend over 600 stocks in about seven months and be considered a stock picking guru?

1:00 UPDATE

DIPS AND RIPS

STRONG ARMS

"We have a dichotomy between the Dow and the other averages. On Wednesday, the Dow, but only the Dow, went to a multiyear high. Moreover, a legitimate breakout is usually accompanied by much heavier volume and a widening trading range. We have had neither.

This, then, can hardly be considered a valid breakout, at least until the other averages confirm the move. In the meantime, the wide swings in both directions on the Dow in the last two days indicate increasing indecision after the advance that began at the end of January.

It is an indecisive market, but one that has had a good advance, and appears to be encountering resistance. I continue to believe some profit-taking is in order. "

RUDE CRUDE

Crude-oil futures ripped higher early Friday as energy traders weighed a report of an explosion in Saudi Arabia, escalating tensions in Iraq and a report of more trouble for Royal Dutch Shell in Nigeria against U.S. data showing the nation well supplied with oil and petroleum products.

Crude for April delivery jumped as much as $62.38 a barrel, up $1.84, after a report sourcing the al-Arabiya television channel of an explosion and shots fired at an Eastern Saudi Arabian oil refinery.

2.23.2006

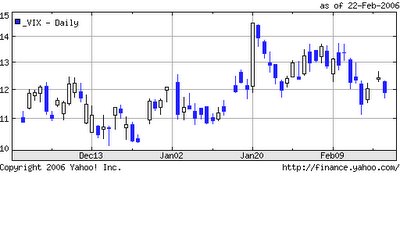

TRADING BY THE VOLATILITY INDEX

If one looks at these two Indexes together, one can see a definite relationship between the VIX index and the SPY index. When the SPY goes higher, the VIX generally goes lower and vice versa. A good general rule is that when the VIX is stretched 10% or more from its 10 day moving average, its time to either BUY or SELL the indexes.

YUP

TUNED IN

Well that APPL/GOOG tandem was a pretty good tell that the market wasn't going to tank completely. Now the adv/dec lines have basically gone flat and there isn's much edge on the day- I suspect that both longs and shorts will be able to make money fading the dips and rips- Also note that the DJIA, as usual, is misleading at negative 50.

OUT OF THE GATE

QUOTE OF THE DAY

I agree 100%- but one can still buy pullbacks and sell blips-

2.22.2006

Trading Techniques

A little more on my trading techniques- I like to buy lower and sell higher- One method - Follow the VXO - the volatility index on the OEX or the SP 100- If one looks back to January 20, the index spiked to about 14 when the 10 day SMA was about 11.8. The SPY was about 126, a fine time to buy. Today, the SPY is in excess of 129 and the VXO is under 11 and the 10 day SMA is just under 12. Probably a fine time to sell. If one looks at the VIX and VXN, the volatility indexes for the SP 500 and the Nazdaq 100, you will see similar patterns. So this is one method I use to buy lower and sell higher. BUY OR SELL ETF'S WHEN THE VOLATILITY INDEX'S ARE STRETCHED FROM THERE SHORT TERM MOVING AVERAGES More to follow-

Don't Have to Stop Trading

Well Jim Cramer isn't around today so we dont have to stop trading now- but, as mentioned in earlier posts, I certaintly didn't expect this move in the markets today- However, as I write, the CBOE Volatility Index is now under 12 and down 5% today. This is not a good buy point imvho. The VIX is now about 6% below its 10 day simple moving average. I think the sidelines suits me very well right now. I expect there will be better entries sooner rather than later.

PM Markets

90 Minutes In

Morning Markets

BLACK GOLD

"The activities over the weekend regarding hostile activities in Nigeria only reinforce the view that the energy markets are a much more complex calculation than a simple current inventory sum. The dynamic now includes not only the U.S. and OPEC but emerging market countries and production in areas that are at best politically unstable. Add that to the fact that much of the OPEC supply is in hands that can best be described as volatile. National security, lack of alternate sources plus little in the way of discovery in the past few years is adding a large premium to the simple view of supply and demand. As I have indicated before, I do not see oil at $100/bbl any time soon, but OPEC seems to be prepared to defend at least $50/bbl. At any level in between, oil producers and refiners will see cash coursing through their corporate veins, which should also get reflected in their share prices."

2.21.2006

THE WRAP UP

The closing numbers DJIA -46 NAZDOG-20 SNP 500 -4.3

2:00 PM Markets

MIDDAY MARKET

Gap Opening?

2.20.2006

DEFINITIONS - VOLATILITY INDEXES

The VXN measures volatility on the Nazdaq 100 index, the VXO on the OEX 100 and the QQV measures volatility on the QQQQ Nazdaq 100 tracking stock.

2.19.2006

A Terrific Value Investor

Another Housing Bubble Story ?

Have Commodities Peaked?

The Greatest Stocks of the Past 10 Years?

On The one Hand, No but on the other?

How Much for that Bar?

What's at the Buffet now?

BOOYA JIM, BOOYAH

Buy the Oil Pullback?

Big Cap Pharma To Outperform- Here is a Good Way to Play

Purpose of the blog – to provide some interesting commentary and maybe even help make some money-

My methods – Buy Low Sell Higher-

How do I know whats high and whats low- u will have to read on-

Is the market High or Low Right Now?

My indicators say High-

What are my indicators?

- Moving averages of the net advance / decline line, and how far it is stretched from moving averages

- how far SPY QQQQ IWM SMH etc is strectched from its short term moving averages

- 2 day Relative Strength Index's (RSI) of the aforementioned ETF's in excess of 90 or under 10

When these indicators "line up" i will be buying ETF's or E Minis -

More on these trades as situations develope- Flat is the present course of action