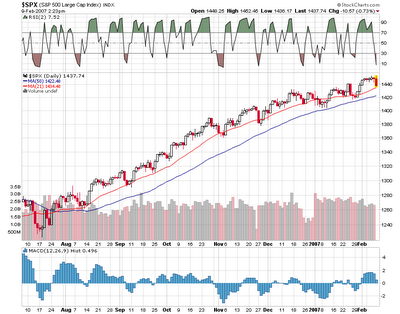

TECHNICALS- SPX

Markets have turned lower on the heels of some dissappointing news from MU and some "unpleasant" comments from some guy at the Fed. Overbought market conditions may also be contributing to the turn around.

The worst performing major market indexes are the "tech heavy" NAZ and the small caps.

Strongest sectors are metals and utilities while the worst are gaming, reits, brokers, small caps, airlines, tech, internets and semis.

Market internals are very ugly with a red 1,400 on the NYSE and red 1,200 on the NAZ.

The NDX has about 13 gainers with CMVT BRCM LVLT MEDI up and WYNN AKAM JNPR NIHD and NVDA lower.

The OEX has about 25 winners with GM F AVP NSM and AES higher while ATI LEH DIS MER CSCO C and GOOG are leading to the downside.

Volatility indexes have turned way green and the VIX/VXO are both near the 11 level and about 6%/7% above their 10 day SMA's. No buy signal yet but maybe on Monday if they take em down a little more.

The SPX is giving a little buy signal with the 2 day RSI under 10 and a pullback to the 21 day SMA which has been a pretty good buy level in the past. The recent tight trading range is skewing the RSI reading as a small dip now results in a buy signal. So just some food for thought.

Futures are trading slightly lower this AM with some interesting news on the wire:

Futures are trading slightly lower this AM with some interesting news on the wire: