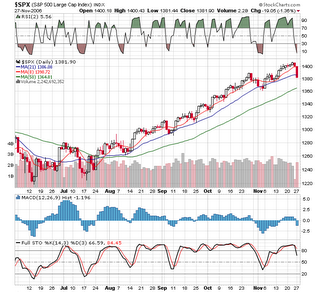

Markets closed the day at/near their highs as suspected in light of the day of the month and the protect the gains scenario.

Sector winners included oils, brokers, silver, tech, drugs and small caps while semis, trannies, retail, internets, software and airlines were lower. The semi sector recovered about 2/3rds of its early losses into the close and may be a strong area for the rest of the week.

Market internals flipped to green with +975 on NYSE and flat on NAZ. The fixed income skewed again with the rates back down to 4.5% on the 10 year Bond.

And for the bad news, Cramer is now yacking on his site about missing the oil rally and now "must own" XOM. Ugh.

Another site is tracking Jimmy and he is even responding trying to defend his record. Hmmm, check out the

CXO blog to get the whole scoop but here is their conclusion:

"Mr. Cramer's predictions sometimes swing dramatically from optimistic to pessimistic, and back again, over short periods. It is difficult to infer his guiding valuation theory. We wonder whether he tends to be swayed by the arguments of forceful advocates with whom he recently interacted.

Investor sentiment is sometimes an important contrarian indicator for him. When he sees most investors leaning one way, he advises to go the other way.

He sometimes anchors on historical analogies (samples of one), such as: "it's '91 all over again" or "I'm placing my bets for 2004 strictly using 1994's tip sheet."

He is prone more to headline hyperbole than equivocation.

For example, from 1/21/01: "This is the lowest-risk, highest-reward environment possible." Approximate Index values <(NAZ 2,600 SPX 1,360)>

And from 3/24/03: "...the risks of owning stocks are as high as I have ever seen them, and the rewards the least certain." Approximate Index values <(NAZ 1,000 SPX 850)>.

Mr. Cramer is right about 47% of the time with his stock market predictions, just below average."

So what are those odds with slippage/commissions and the time value of watching him and the CNBC sycophants? Not a good use of time or money but definitely fun to blog about.