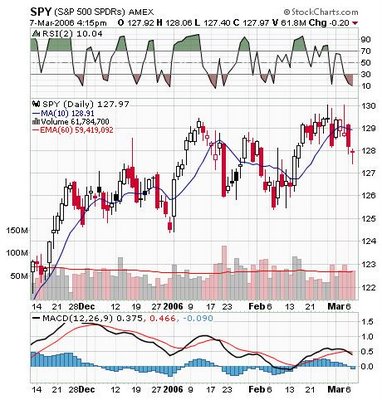

One of the newspapers that I read every day is the

Investors Business Daily (IBD). This newspaper is a great tool to find stock ideas and read stories about up and coming companies.

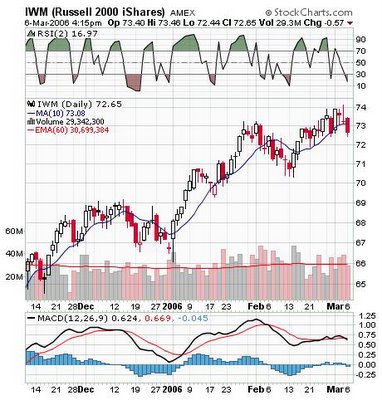

The paper is best known for its technical ratings of stocks and its

IBD 100 stock list, which they update on a weekly basis. IBD 100 stocks are generally stocks registering the greatest earnings per share growth and the best stock price performance.

IBD measures Earnings Per Share growth (EPS) by ranking earnings growth over the past three years with a heavier emphasis on the two most recent quarters. Each stock is rated on a relative basis on a scale of 1 to 99 with 99 being the best.

Relative Price Strength (RS) measures a stock’s change in price over the most recent twelve months. The stock’s price 12 months ago is compared to the current price. The change is compared to the current price and compared to all other stocks. The rating is again between 1 and 99 with 99 being the best.

These stocks have a tendency to be very volatile and a great deal of money can be made on them. The opposite is also true and if one were to take a shot at any of them my advice would be to spread the risk by buying limited amounts of any one stock or any one industry. In addition, scaling in to purchases is the only way to buy these stocks. In other words, don’t buy a full position at once.

I find the stocks below to be of interest at this time:

CIB

CIB provides banking services to business and individuals in 127 cities in Columbia. It has an EPS ranking of 95 and a RS ranking of 95. There are approximately 182 million shares outstanding and it is currently about 2% off its 52 week high.

GG

GG is engaged in the acquisition and development of precious mineral properties in the Americas and Australia. It has an EPS rating of 98 and a RS rating of 94. There are approximately 340 million shares outstanding and it is at its 52 week high.

GWR

GWR operates shortline and regional freightline railroads in the U.S. and South America. It has an EPS ranking of 91 and a RS ranking of 93. There are approximately 27 million shares outstanding and it is just about at its 52 week high.

INFA

INFA is a developer of enterprise data integration software. It currently has an EPS rating of 99 and a RS rating of 94. There are approximately 81 million shares outstanding and it is about 5% below it 52 week high.

JOYG

JOYG is a manufacturer of mining equipment, longwall shearers, electric shovels and blasthole drills for coal mining extraction. It currently has a 99 EPS rating and a 97 RS rating. There are approximately 121 million shares outstanding and it is about 5% off its 52 week high.