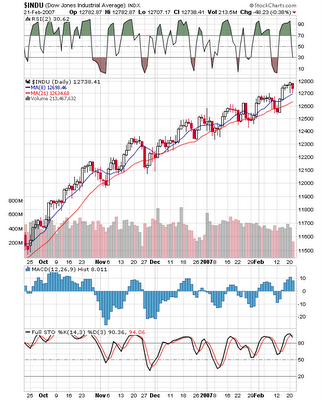

MY BARRON'S BOUNCE

Barrons bouncer Michael Santoli with a bullish column on BAM, one of this bloggers key holdings. BAM is an investment conglomerate with different holdings all over the world and is also an investment favorite of value investor Marty Whitman, whose Third Avenue group owns about 4.5% of the company ($20 Billion Mkt cap company).

And if you want to check some other "value picks" from Whitman, the Mutual Series group and David Winters of Wintergreen (formerly of the Mutual Series group) , one may want to take a shot at FCE.A CTO JOE DEL or TRC.

Winters fund, WGRNX, owns about 16% of CTO and was buying it as recently as last week according to MORN; and the highly respected Third Avenue Real Estate Fund, TAREX, owns about 9% while the Third Avenue group as a whole owns about 11%.

The Third Avenue group also owns about 21% of FCE-A, a real estate holding company run by the Ratners of Cleveland and New Jersey Nets fame. The Ratner group of officers and directors owns about 30% of the company according to the FCE-A website so their is not much float as the value funds and insiders hog the shares.

JOE, a real estate company based in Florida is also on the value list with Third Avenue Funds owning 19.5%; Hotchkis % Wiley about 10%; Marsico group with 10%+; Janus group with 7% and Neuberger Berman and BEN with 5% each. According to the YHOO finance holdings page, the big investment groups own a combined 70% of the stock, so again not much float.

The Third Avenue group also owns more than 25% of TRC, a real estate company with holdings of about 270,000 acres of land about 50 miles outside of Los Angelos.

T Rowe Price and the Third Avenue group each own about 9% of DEL, a timber/real estate company with holdings of about 450,000 acres of land in Arkansas and Louisiana.

Note that the holdings percentages listed above came from either YHOO Morningstar Mutual Funds site or other sources which I believe are "fairly" current.