CLOSING LOOK

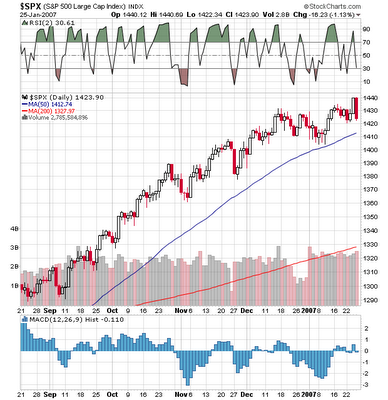

The markets gave the longs and the shorts a bit of pain as dips were bought rallies sold and the only line that held was support on the SPX at the 1,417 area. The DJIA pivots were useless as were the lines on the YM. In addition, market internals started green, quickly flipped to red and flipped back to green in the late afternoon. A nice day to be somewhere else but at the screens.

The SMH flipped to green early and stayed there and was the best hint that the markets may flip. Other strong sectors were crude, silver, small caps, emerging markets, software, metals, utilities and tech while biotechs, internets, trannies, airlines, drugs and homies led lower.

Market internals closed with about 1,000 more winners than losers while the NDX/SPX/OES all had slightly more losers than winners.

The 10 year Bond closed at 4.88% and continues to give equity holders grief as alligators (asset allocators) may be flipping out of equities and into bonds.

GOOG ICE CME GS KLAC all closed green while MS MER and AAPL closed red.

Volatility indexes gave back early morning gains and all have closed in the red.

Strongest stocks included ATI F CAT KLAC SNDK VRSN CFC FII and SYK while CDWC AMGN EBAY JOYG HAL and BAX were ugly.