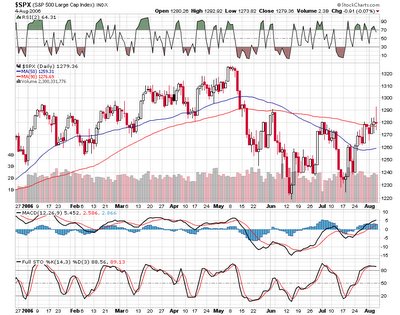

Trade of the day, the gap fill. Anyhow, the markets are mixed with internals showing about 500 more losers than winners.

Bill Miller is probably making up some ground vs. the SPX as the internet stocks are flying with EBAY GOOG AMZN and HHH all higher. The guy on realmoney.com may have called

the bottom in GOOG, but there is still a big gap to fill at the 350 level. And why don't I hear about GOOG price targets anymore and how about Jimmy with his

$600 GOOG, and for all the homegamers, he made that call on April 21 when the price was $70 bucks higher.

Homies, airlines, internets, retailers and trannies are the best performing sectors with oils and metals being the worst.

Tony Crescenzi, the fixed income maven at Miller Tabak, is reporting the odds of an August rate hike have increased to 42%, and the market is priced for 46% odds of a hike at the Sept 24th meeting assuming no August hike. I will admit, it looks like a 50/50 proposition to me , but I do know that the numbers will change significantly after tomorrows job numbers.

Other interesting information - the composition of the SPX as of June 30:

Consumer Staples 9.6%

Consumer Discret 10.2%

Utilities 3.4%

Telecom 3.3%

Materials 3.1%

Technology 14.9%

Industrials 11.7%

Health Care 12.3%

Financials 21.4%

Energy 10.2%

Biggest components- XOM 3.23% GE 2.98% C 2.09% BAC 1.91% MSFT 1.78%

PG 1.59% JNJ 1.54% PFE 1.5% AIG 1.33% MO 1.33%

It still looks like a bid remains under the market but it may expire in the next few days along with the beginning of the month money.

Looks like we are at the high end of the SPX range which I define as 1235/1285 and I have no buy or sell signals, just closer to the top than the bottom. FWIW, I have no index longs but some QQQQ short.

Looks like we are at the high end of the SPX range which I define as 1235/1285 and I have no buy or sell signals, just closer to the top than the bottom. FWIW, I have no index longs but some QQQQ short.