THE SILVER STANDARD

There has been lots of talk recently about the rip higher in the precious metals. Several months ago two ETF's for Gold (ITU and GLD) became available and one for Silver (SIL) will be available in the very near future.

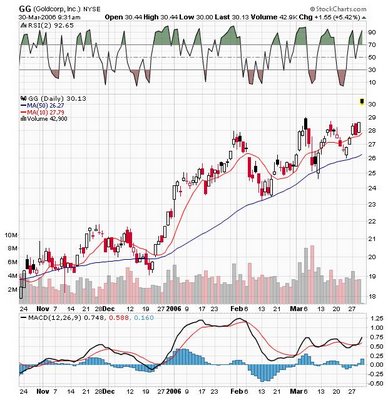

There has been lots of talk recently about the rip higher in the precious metals. Several months ago two ETF's for Gold (ITU and GLD) became available and one for Silver (SIL) will be available in the very near future.So is this a good time to buy precious metals/equities? The answer is that the commodity and the metal stocks have had huge runs and are probably due for some consolidation or lower prices. However, the commodity run which began in 2003 probably has a lot of life left. Prior history indicates that commodity runs usually last ten or fifteen years so it may still be early in the game. In addition there is increased demand from the BRIC countries which will probably keep a bid under the precious metals for a long time.

There is also much speculation about the impact the Silver ETF will have on silver demand. I am not a silver expert, but I have read a number of articles indicating that the ETF will soak up a lot of the available silver. This article on Marketwatch delves further into the argument.

It is also hard to forget about the presumed top in Gold when the GLD ETF appeared in December of 2004. Gold was then in the $450 per ounce range and now it is $580. It was a good time to buy gold then and my suspicion is that if silver sells off on the debut of the ETF, it will also be a good time to buy.

My plan is to buy the dips in Silver stocks such as SSRI and PAAS and have a somewhat smaller position in the silver ETF. The stocks mentioned are the favorites of Laurie McGuirk, the Metals maven at Minyanville.com and he has been spot on picking these stocks at much lower levels. One note of caution, just because a stock is a gold/ silver stock does not mean it will automatically go to higher prices if the commodity does. Stock picking is required.