CLOSING TRADE

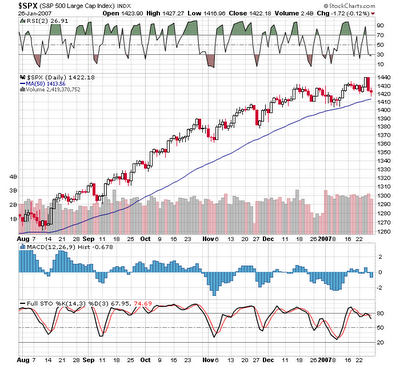

Markets traded in a tight range for most of the day with the "tech heavy" NAZ acting best and the Big Cap DJIA taking a bit of a rest. The DJIA closed -20, NAZ +7.5 and SPX +2.5.

Strongest sectors were homies, semis, tech, oil service, brokers, internets, financials and midcaps; on the darkside were metals, gaming, silver stocks, integrated oil and retail.

Market internals were fair with +530 on the NYSE and +255 on the NAZ.

The NDX was strong with about 63 winners; OEX had about 55 green and SPX about 3/2 to the green.

The DJIA looks overbought and is probably ready for a little pullback as the VXD (vol index of the DJIA) is also in an area where it has recently found a bottom. As I mentioned earlier, perhaps a little jig on Monday as the late buyers prop it up and then the beginning of a decent sell off as traders ring the register.