THE BARRON

The folks at Barron's have put together a great issue highlighted by a terrific thought provoking article by everyone's favorite CNBC guest commentator, Michael Santoli. The article discusses the divide between the real wealthy and every one else and how investors of every ilk might be able to profit from the super well to do. Michael notes how C and others have assembled a basket of stocks that benefit from the super rich; in the basket are names such as TIF COH BID RL and FS. I agree 100%.

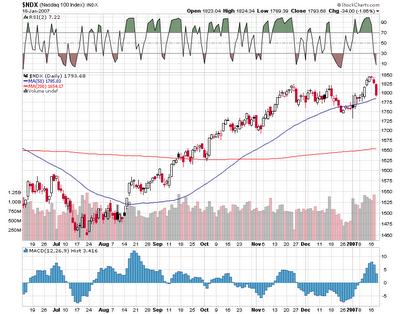

The folks at the roundtable also have some interesting picks such as LYO HIG and PXD. Bill Gross mentioned the EFA ETF which is a play on foreign markets and the weakening dollar. I agree 100% again.

Finally, Abbey J. Cohen is of to a lousy start for the year as her picks have included two stocks that have already blown up- SYMC a few days ago and GE yesterday. She always says she is not a stock picker and not sure what she does at GS besides give interviews, but if it works for them and the stock price (GS), that's ok too.