THE CLOSE

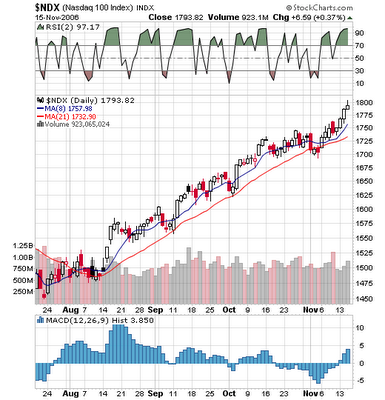

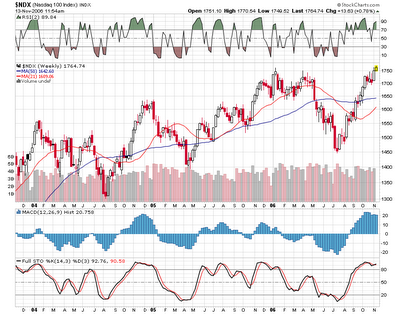

Shockingly the markets again closed at/near their highs for the day as the DJIA was the stellar major index in the new big cap rally. The IWM and the NAZ came way back off their lows and managed to finish near the break even level.

Sector winners today included oils, drugs, biotechs, internets and big caps while airlines, trannies, software, tech, gaming and retail were were the worst groups.

Market internals also came all the way back closing with about 750 more losers than winners after opening near the magic 2,000 issue loser level.

Two ugly stocks today were SBUX and GS, one on earnings from yesterday and one on a little pullback. They are both probably buys next week as I expect the major indexes to drift up into the holiday.