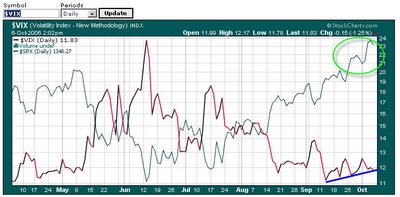

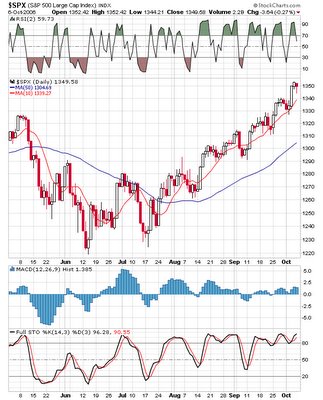

TECHNICALS-SPX/VIX

Just wanted to quickly mention an observation from one of the Minyanville.com profs, Steve Shobin, he points out another Negative Divergence (top chart) as the VIX is higher now as the markets are also higher. Generally, as the markets go higher, the VIX goes lower, so just a heads up as another Neg Divergence appears.

Just wanted to quickly mention an observation from one of the Minyanville.com profs, Steve Shobin, he points out another Negative Divergence (top chart) as the VIX is higher now as the markets are also higher. Generally, as the markets go higher, the VIX goes lower, so just a heads up as another Neg Divergence appears.It seems like I have been looking at Negative Divergences since the lower highs starting showing up on the MACD Histogram in August. And if you shorted the SPX starting at that point, well you aren't doing nearly as well as the folks who went long that divergence. In addition, the stochastics have been twisting above the 80 line (typical sell signal) for about a month, so again, the markets can move against a position for longer than a trader can stay solvent.

For the Yankee fans, be advised that they have now lost 8 out of their last 10 play off games and are probably due to win two in a row. If they don't win this series, I will go out on the limb and predict Torre and lots of the other regular season stars will not be back.

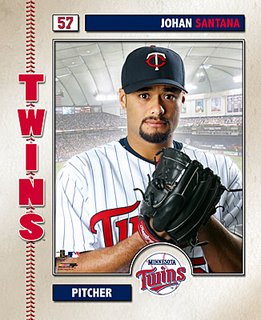

And as I type the A's go up 4-1 on the Twinkies and who would have thought after the season the Twins had that they would be such an easy sweep out of the playoffs. Who can't wait for an A's vs. Tigers ALCS?